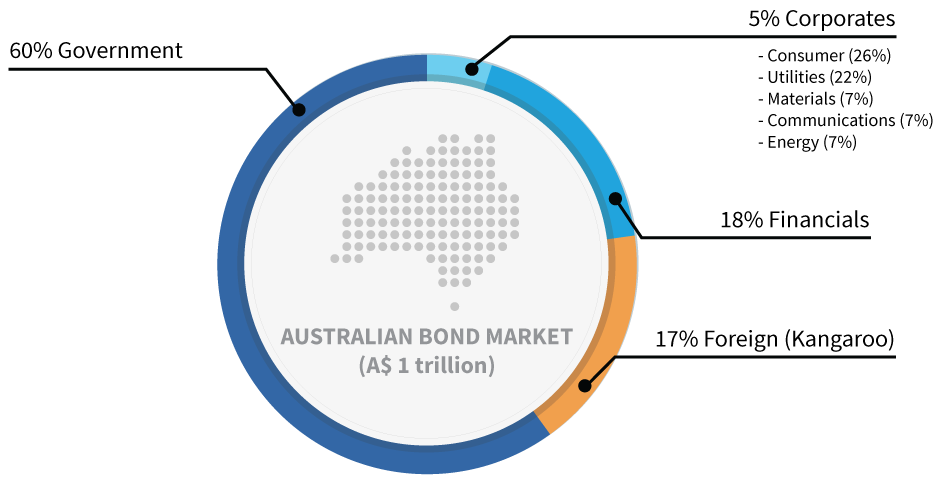

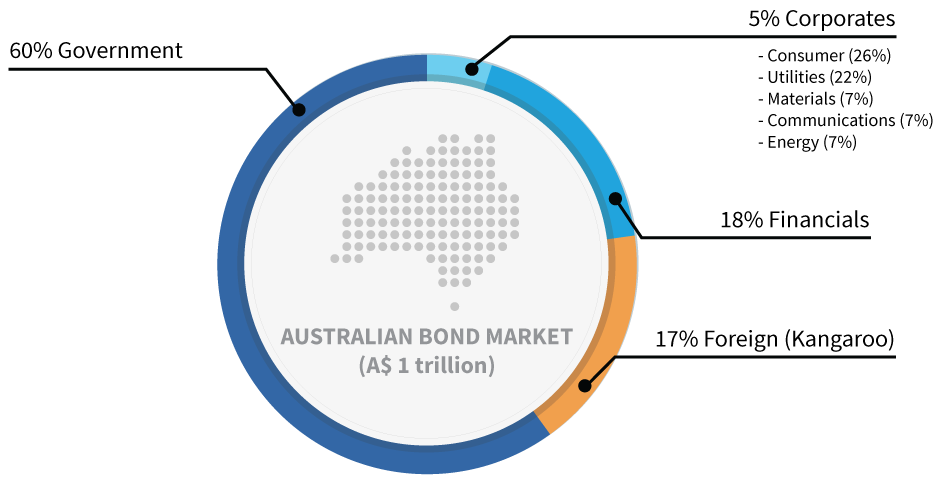

Australia has a large and active over the counter (OTC) bond market with over $1 trillion under issuance by international and domestic corporations and governments. The bond market plays an important role in providing corporates with a wider range of long tenor funding options in addition to the traditional banking market.

The bond market represents two thirds of the capitalisation of the ASX, however annual turnover of $2.5 trillion is over two times the ASX. Listed bonds represent less than 5% of the OTC bond market.

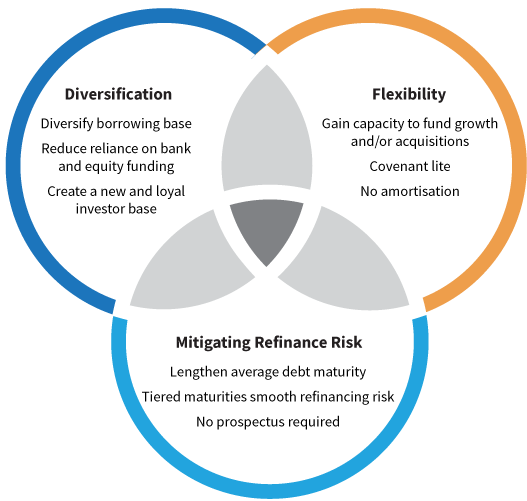

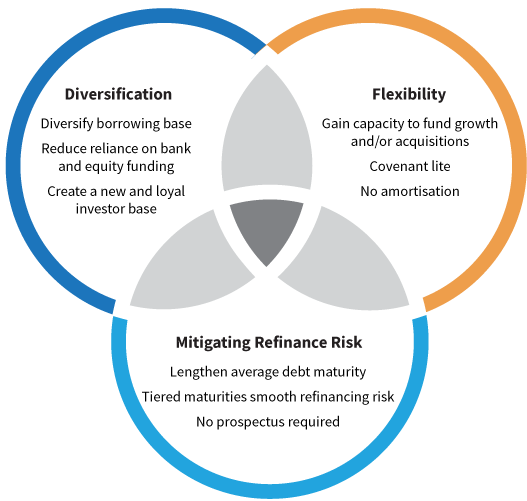

The Bond market enables corporates to implement a flexible capital structure that is aligned to their strategic objectives, creating an optimal mix between short term liquidity facilities, long tenor bond funding and diversity of funding sources.

Reducing funding concentration is critical to ensuring that the business has in place flexible debt facilities that can accommodate changes in operating conditions and economic volatility.

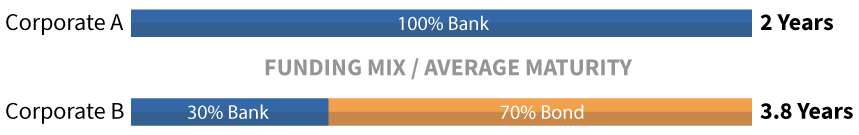

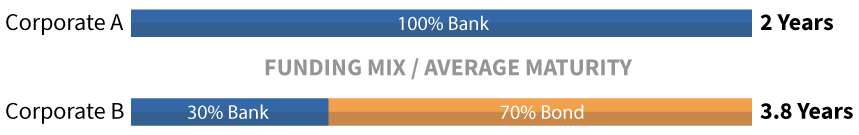

By optimising the balance between short term funding, such as bank debt, and long term funding, such as bonds, corporates can mitigate refinancing risk and reevaluate debt facilities based on the funding environment and their strategic requirements.

Bonds can be structured to have tenors of greater than 5 years, flexible covenants and no amortisation, complementing short term bank facilities and increasing the stability of a company’s capital structure.

Borrowers can create a competitive environment for their capital, leading to improved covenant packages, reduced funding costs and retention of funding headroom.